The Goods and Services Tax (GST) was proposed in 2016 and went into effect in 2017. It was imposed by the Centre to get rid of the indirect taxes which were imposed.

Taxes like excise duty, VAT and service tax are now subsumed and there is no cascading effect of tax. GST is levied on both goods and services that are sold in the country.

There was an “Amendment Act in August 2018 which proposed various changes in the GST” tax slabs for goods and services under GST.

What are the Different Types of GST?

There are 3 kinds of GST that are imposed are listed below.

SGST/UTGST

It is the tax collected by the state and union territories (UTGST) in situations when the transaction is within the state or UT. For example, when a product is manufactured as well as sold in Odisha, SGST will be imposed by the state government on that particular product.

CGST

It is the tax added by the Central Government in transactions that take place inside the state. For example, if a product is manufactured in Assam, then there will be SGST, as well as CGST imposed.

IGST

GST or Integrated GST is the tax imposed by the Central Government when the transaction takes place between the states. It happens when the location of a supplier of the goods/service and the place of consumption lie in different states.

For example, if the goods are manufactured in Kerala but they are consumed in Maharashtra, then the Central Government and State Government levies the IGST.

What are the Benefits of GST?

GST has many advantages and was hailed as a welcoming change in the economy. The fact it became an online procedure makes the process a lot simpler.

Easy Online Procedures

The entire process of GST can be done online. There is no hassle of hard copy registration and running from post to post to get various registrations done.

Eliminates the Cascading Effect

Before GST, there were a lot of indirect taxes charged at every step of the taxation process. Now all those come under a single umbrella and the cascading tax effect has been eliminated.

Unorganized Sector is Regulated

Earlier, there were many sectors that were hard to control. The construction and textile industries were highly unorganized. After GST, there are mandatory online compliances and payments that has made the industry more responsible.

The Changes brought by the GST Amendment Act

- The Central Board of Excise & Customs (CBEC) was replaced by the Central Board of Indirect Taxes and Customs (CBIC).

- It removed the definition of Business Vertical.

- Now the activities of race clubs will be a business and come under GST.

- The facilitation of transactions in securities will also come under “services.”

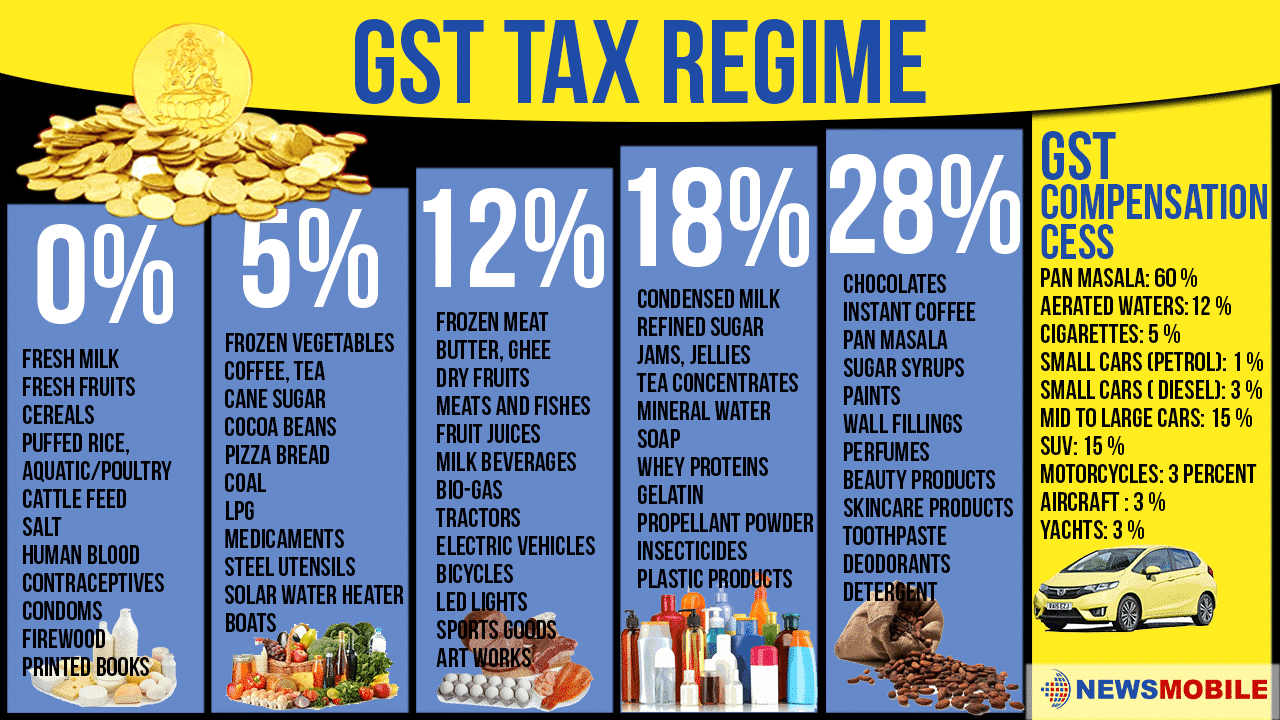

What are the Different GST Rates?

GST Rates on Common Items

There is GST on Common Items like tea, coffee, and soaps. Household necessities such as edible oil, sugar, spices, tea, and coffee (except instant) are included 5% GST. Same as Misti/Mithai (Indian Sweets) and medicines.

The tax on computers and processed food is 12% and on Hair oil, toothpaste and soaps are 18%.

The tax on luxury items is higher. Small cars, AC, Refrigerators, premium cars, sports bikes, cigarettes and aerated drinks are levied 28%.

GST Rates on Goods

After the GST, the Government now has a 4-tier tax structure. For all the goods and services, there are four slabs – 5%,12%,18% and 28%. Some items have zero GST. Items like barley, wheat, oats, rye, vegetables, books, incense sticks, kajal and many more articles enjoy no tax.

GST Rates on Services

For services, the Government imposed a similar 4 tier structure of 5%, 12%, 18% and 28% and the educational and health sectors were spared from GST.

GST on Loans

GST for loans works differently. It is only levied on the processing charges and any other charges paid to the bank. This excludes the principal repayment and interest payment. A Personal loan has 18% GST, the same as home loan and car loan.

GST on Cars

GST on cars, personal use or luxury is 28%. But in addition to GST, there is a composition scheme that takes the overall tax rate high. Subsequently, it ranges from 29%-50%. However, cars with cleaner technology have lower tax rates.

GST on Gold

The “GST rate on gold” currently is 3%. However, if you include the making charges, it becomes 5% GST. If the worker is outsourced, then the seller can add it as an input tax credit (ITC). Then, there will be only 3% GST charge applied to the final bill paid.

GST on Real Estate

GST doesn’t apply to a property that’s already constructed and lived in. But if you purchase a property that’s under construction, then a 12% GST is applicable.

GST on Food

There is no GST on food items, especially fresh food. Packaged and processed foods like chocolates, dried spices do have a GST rate of 5%-18%.

What are the Different GST Slabs?

5% Tax Slab

5% tax is on printing of newspapers, goods transported in a vessel from outside India or import, renting a motor cab without fuel cost, transport services in AC or radio taxi, transport by air and tour operator services.

12% Tax Slab

There is a 12% tax slab on rail transportation of goods in containers from a third party other than Indian Railways, air-travel excluding economy class, food and drinks at restaurants without AC or liquor license.

Moreover, for renting rooms or hotels for more than Rs.1000 and less than Rs.2500 per day. It is also applicable to construction business and movie tickets.

18% Slabs

In the 18% slab, we have dental wax, school satchels and bags other than leather or composition leather. There are also handbags and shopping bags of artificial plastic material, cotton or jute.

In transportation, there are Rear Tractor tires and rear tractor tire tubes, rear tractor wheel rim, tractor center housing, tractor housing transmission, tractor support front axle. In electronics, transformers, set-top boxes, lamps, wires and CCTV.

Restaurants with a liquor license will have to pay an 18% tax slab on food and drink. There will also be a GST on Outdoor catering services and renting for accommodation for more than Rs.2500 but less than Rs.5000 per day.

Businesses like circus, Indian classical, folk, theatre, drama and event management also pay an 18% tax slab.

28% Tax Slab

All the luxury items mentioned above, like a sports bike, luxury cars and AC are under the 28% tax slab but there was a council meeting to ‘reduce’ the tax rates on certain items based on customer preferences. After that, no more items were added to the list.

Amusement parks, water parks, theme parks, joy rides, merry-go-round, racecourses, go-karting, casinos, ballet, sporting events like IPL, race club services and gambling, all these services are under luxury services and the Government imposes a 28% tax on them.

Food and drinks at AC 5-star hotels also have the same tax slab.

No GST

No GST will be charged on chargeable services offered on Basic Savings Bank Deposit (BSBD) account opened under the PMJDY (Pradhan Mantri Jan Dhan Yojana) and for Hotel accommodation which costs under 1000

Recently our Finance Minister, Smt. Nirmala Sitharaman hinted that some new products would come under the GST system. The addition of new products to the list will reduce the” GST rates” on some products. However, there might be GST on some products like Petrol and Diesel, Land and Electricity.